On Thursday 28 October 2021 Immobel SA/NV (“Immobel”) announced the launch of a public offer in Belgium of 6 ½ - year green notes (the “Notes”) to both retail and, to a certain extent, qualified investors. The Notes were succesfully placed on 28 October 2021 with mostly retail investors following a book-building process where BELFIUS and BNP PARIBAS FORTIS have acted as Joint Bookrunners and Joint Green Bond Structurers and BELFIUS, BNP PARIBAS FORTIS and KBC have acted as Joint Lead Managers.

Since the maximum amount of EUR 125 million was raised, Immobel decided to close the subsciption period early on 28 October 2021 at 17h30 CET.

In case of oversubscription, a reduction of the subscriptions may apply, i.e., the subscriptions will be scaled back proportionally, with an allocation of a multiple of EUR 1,000 and, to the extent possible (i.e., to the extent there are not more investors than Notes), a minimum nominal amount of EUR 1,000 which corresponds to the denomination of the Notes and is the minimum subscription amount for investors. Subscribers may have different reduction percentages applied in respect of the amounts subscribed by them depending on the financial intermediary through which they have subscribed to the Notes. The subscribers will be informed regarding the number of Notes that have been allotted to them as soon as possible by the relevant financial intermediary.

The Notes will be issued on 12 November 2021 and will be listed and admitted to trading on the regulated market of Euronext Brussels (ISIN BE0002827088). The gross actual coupon pays 3.000%. The gross actuarial yield amounts to 2.68% on an annual basis and the net actuarial yield amounts to 1.79% on an annual basis.

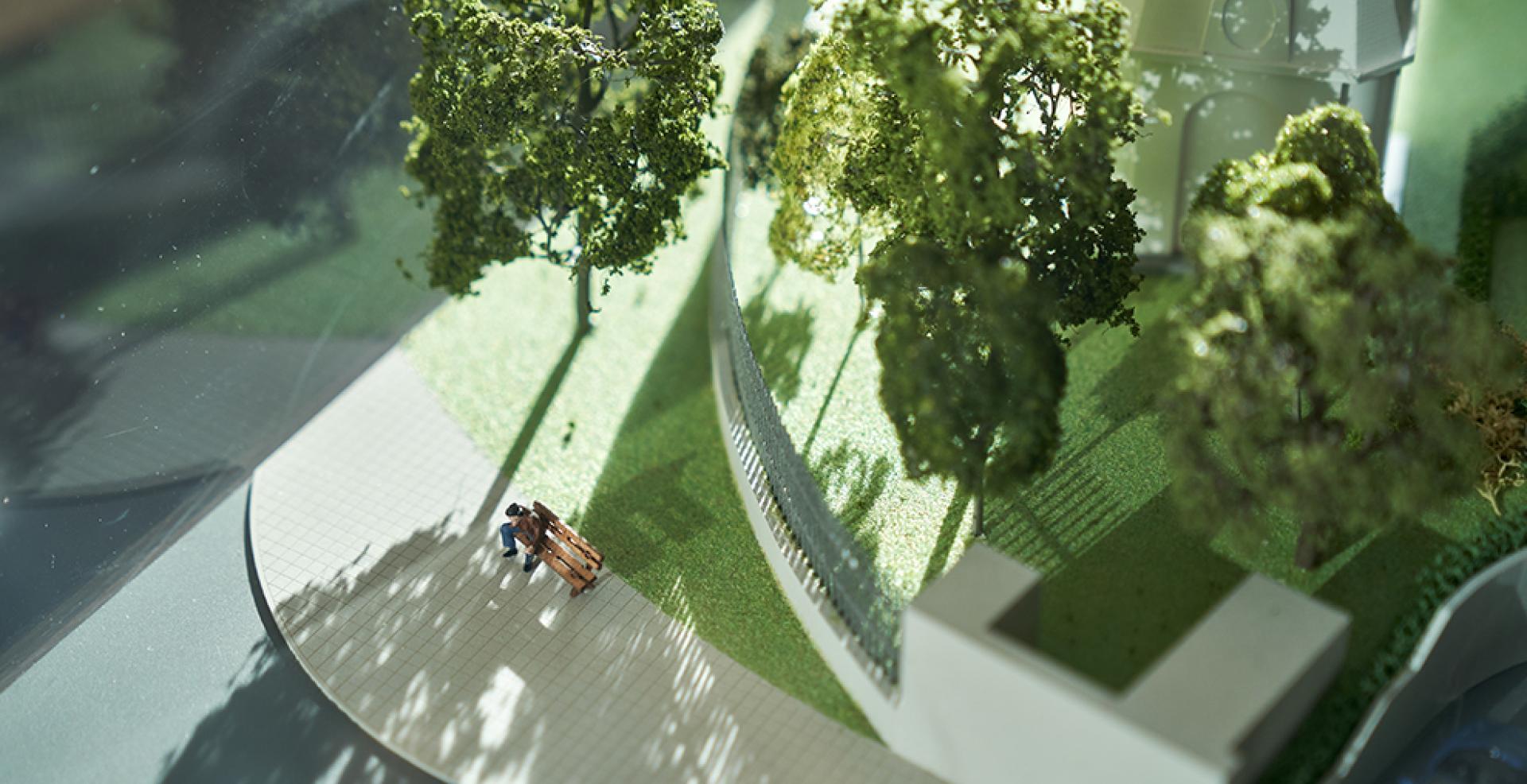

“The issuance of this bond will allow us continue developing our projects with high sustainability requirements, to participate in the creation of the European cities city of tomorrow and in particular to strengthen and expand the ESG strategy of the Immobel Group. This success shows the interest of investors in environmental concerns but also their confidence in the Group and the strategy,” explains Karel Breda, Chief Financial Officer.

For this transaction, Immobel was advised by Linklaters and the Joint Lead Managers by Jones Day.

This press release must be read together with the Base Prospectus dated 1 June 2021, the supplement thereto dated 19 October 2021 and the Final Terms dated 25 October 2021 (including the issue-specific summary attached thereto), which are available on the websites of Immobel (https://www.immobelgroup.com/en/publications/bond-issues), Belfius (www.belfius.be/obligatie-immobel-2021 (Dutch) or www.belfius.be/obligation-immobel-2021 (French)), BNP Paribas Fortis (www.bnpparibasfortis.be/emissies (Dutch) or www.bnpparibasfortis.be/emissions (French)) and KBC (www.kbc.be/bonds/immobel 2021 (Dutch) or www.kbc.be/fr/bonds/immobel 2021 (French)).